TurboTax Getting Started Guide for the 2023 - 2024 Tax Season

Tax seasons seams to be a procrastination time of year for a lot of taxpayers, including myself. Tax preparation is a task I generally don't look forward to. However, since I've been using TurboTax software products to file my taxes, I find the task at hand much less intimidating.

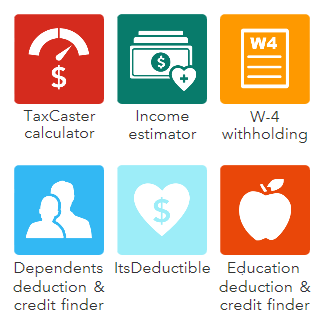

I've learned to stay on top of my liabilities by keeping track of what my tax obligation will be to Uncle Sam... TurboTax 2023 - 2024 products help me do just that. My method for this madness is to use the TurboTax TaxCaster several times throughout the year to stay on top of what I will owe in taxes based on my current income. Read our full review of TurboTax TaxCaster to see how you can calculate your federal and state tax liabilities.

Several tools that the TurboTax 2024 product lineup provide are designed to simplify your tax preparation and filing process. These tools are functionally automated so that you can always file your taxes yourself. This can save you a lot of cash over the prospect of hiring expensive tax professionals like CPA's and accountants that no doubt will eat up a lot of your tax return refund.

TurboTax 2023 - 2024 Offers Service Guarantees

TurboTax Guarantees you the Maximum Tax Return Refund: TurboTax Helps you keep tax preparation costs low and, assists you in taking advantage of every tax deduction you can legally qualify for on your return. It's a guarantee that TurboTax stands behind whole-heartedly. If find that you could get a larger refund or smaller tax due from another tax preparation method, your TurboTax federal and/or state software purchase price will be reimbursed. TurboTax Online Free Edition for simple tax returns only "not all taxpayers qualify" customers are entitled to $14.99 and a state purchase price refund if you paid.

TurboTax Guarantees Accurate Calculations: TurboTax take pride in presenting a running as-you-go total on your tax refund prediction. The calculations are always accurate based on the information entered, and you can see how each entry effects your income tax liability. If you incur federal or state penalty or interest charges due to a TurboTax calculation error, they'll reimburse you for those fines or fees.

TurboTax Guarantees Representation: TurboTax will be there if to represent you in the unlikely event a software error was made, or if you opted for the full audit representation package, which is backed by the TurboTax legal representation. TurboTax Audit Support Guarantee provides FREE year-round professional audit support guidance. Get your questions answered and guidance understanding IRS inquiries.

TurboTax 2023 - 2024 Tax Season Software Review

With the tax season now upon us and the contemplation of preparing our 2024 earned income tax return that is due on April 15th 2024 it's a good bet you're looking for the right TurboTax Tax Software program to do the trick. TurboTax editions are available in two formats, online, or by download. So here's this years TurboTax Software lineup in a nutshell.

- TurboTax Free Edition: for simple tax returns only "not all taxpayers qualify"

- TurboTax Basic Edition: imports your income and personal data

- TurboTax Deluxe Edition: specialized tax deductions and credits support

- TurboTax Premier Edition: design for investments and rental income support

- TurboTax Home and Business Edition: for self employed and small businesses

Online Tax Preparation Discount Prices

TurboTax 2023 - 2024 Prices: The Cost at Different Venues

TurboTax 2023 - 2024 prices vary depending on the venue, and the version. There are two versions, online tax preparation, and downloadable or CD installation desktop software. Online versions cost less so they're not as expensive as desktop versions. As a TurboTax Affiliate Distributor we offer discount prices on their online versions through the TurboTax coupon below. These TurboTax discount prices are time sensitive so get them while you can because by mid tax season they will be gone.

Software Download / CD Discount Prices

Desktop versions can be purchased on sale locally through big box stores like Costco and Sam's Club, Staples and others. Keep in mind that these editions do need to be installed on your computer so there are minimum system requirements, and conflicts could occur between TurboTax and other programs already installed on your computer.

Additionally, many more online distribution avenues offer early tax season sale prices but these tend to all run pretty much the same as the coupon discount prices listed above.

TurboTax 2023 - 2024 Tax Deduction Support

There are many tax deductions that can be taken advantage of for 2023 - 2024 tax filing. When you have big alterations in your life like buying a house, getting married, or having a baby. Even getting more education and job changes hold tax benefits that you could miss out on if your not using the right product to find these special gifts from the IRS.

TurboTax Dependents and Credits Deduction Finder

TurboTax Dependant and Credits Finder

is a tool that is designed to take the complications out of tax preparation when you have changes in your life that influence what needs to be - or should be changed on your federal and state tax returns.The TurboTax Dependents and Credits Finder will help you discover how changes in your life will affect your taxes and how to take advantage of them. Then, your TurboTax software will help you get the biggest refund you can based on your tax filing circumstances - guaranteed!

You don't have to stay up all night learning the new Tax Cuts and Jobs Act (TCJA) tax laws and reading legal mumbo-jumbo. As you enter information about changes in your life, watch for tax tips that have the potential to save you money, and maximize your tax return refund.

TurboTax ItsDeductible Charitable Contributions Tracking

TurboTax

ItsDeductible provides everything you need to keep track of your Charitable Contributions

and Donations, and it Helps Reduce any Risk of an Audit. To do this, it provides resale

valuations for your non-cash donations based on the type of item and its condition by using

values that are based on Official

IRS Charitable

Deduction Guidelines. When your filing your tax return

on April 15 2024 you want your tax calculations to be right, or penalties can happen.

TurboTax

ItsDeductible provides everything you need to keep track of your Charitable Contributions

and Donations, and it Helps Reduce any Risk of an Audit. To do this, it provides resale

valuations for your non-cash donations based on the type of item and its condition by using

values that are based on Official

IRS Charitable

Deduction Guidelines. When your filing your tax return

on April 15 2024 you want your tax calculations to be right, or penalties can happen.

With ItsDeductable, you can keep track all your donated Items along with cash, bonds, mutual funds, or any mileage you incur helping out your charity. It's the perfect tool to help you make sure you get the biggest deduction for all your charitable contributions.

Additionally, all this information can be imported from ItsDeductible directly into TurboTax Desktop Software and TurboTax Online Deluxe, Premier, or Home & Business Editions. It instantly Imports directly into the right tax forms for you come tax time.

TurboTax Health Care Guidance for 2023 - 2024

Health care insurance tax law changes continue and you need to know how it will affect you and what to do? TurboTax Health Care Guidance can help!

If you don't have insurance—you may be eligible for financial assistance. TurboTax 2024 can help guide you in the right direction for health care savings.

TurboTax Military Member Discounts and Support

Honor and Glory, That is what our armed forces deserve for their courage in protecting our country. But, on top of that, TurboTax Military Tax Support is designed to help our troops take advantage of special benefits and deductions just for them!

Military families face many challenges with their finances and tax preparation while on active duty. Today's TurboTax Military Discount Tax Filing offers step-by-step guidance to help military personnel claim every possible tax deduction, benefit, and credit they are entitled to apply for, and deserve!

Do You Qualify To Use The TurboTax Online Edition?

The

TurboTax Online Edition is for simple tax returns only "not

all taxpayers qualify" and a great choice for new users as it guides you to gather

your W-2s and tax documents, then walks you through your simple 1040EZ, 1040A and 1040 tax

return asking simple questions in plain English.

The

TurboTax Online Edition is for simple tax returns only "not

all taxpayers qualify" and a great choice for new users as it guides you to gather

your W-2s and tax documents, then walks you through your simple 1040EZ, 1040A and 1040 tax

return asking simple questions in plain English.

Choose the TurboTax Online FREE Edition if you have simple tax return needs. This edition works well for any income level and is an easy way to prepare your taxes for FREE. This Edition does NOT cover tax form schedules C, D, E, and F.

Just a note: if you're not sure which tax software edition will work best for your tax filing needs, start with a lighter edition and TurboTax will prompt you to upgrade if the initial tax software interview process determine another edition will work better for your tax filing situation.